Global Standards Mapping Initiative (GSMI)

Comprehensive resources and recommendations for the blockchain ecosystem to navigate the complexities of the global digital asset landscape, across 5 key areas:

Legislation and regulatory guidance

Technical standards

Industry standards and recommendations

University courses and degree programs

Industry consortia

Key Findings

- Global Regulatory Developments from 210 Jurisdictions

- 7 Fact Cards with Key Themes on Blockchain and Digital Assets

- 700+ Accredited University Courses and Professional Certifications

- 50 Technical Standards Bodies Advancing Blockchain Developments

- Blockchain and Digital Assets Landscape with 2,000+ Players

- Country Spotlight on Blockchain Developments in China

Where is Blockchain Being Taught?

Blockchain is being increasingly incorporated into the curriculum taught at universities and other educational institutions around the world, offering academic degrees and other certifications. We have compiled this repository of over 700 courses spanning multiple academic disciplines. We hope that by compiling this repository of courses related to blockchain, we will make it easier for those looking to get a more formal education to access the training they want. We also hope this resource can help educators connect with each other to promote knowledge sharing and other collaborations such as research on common topics. Below is a listing of blockchain-related courses in universities and other educational institutions, as well as a form to collect additional submissions for courses. Students, professors, and other university staff can submit their blockchain courses for inclusion through this form and apply for the GBBC observing membership program.

# of Courses

Courses by

Academic Field

- Law 5%

- Computer Science & Engineering 48%

- Professional Studies & Certificates 9%

- Business & Entrepreneurship 32%

- Economics & Humanities 6%

Courses by

Region

- North America 29%

- Latin America & Caribbean 13%

- Europe 22%

- Oceania 8%

- Asia 10%

- Africa 18%

Courses by

Degree Level

- Undergraduate 32%

- Undergraduate and Graduate 2%

- Professional Studies & Certificates 19%

- Graduate 41%

- Other (Doctorate, Research, etc.) 6%

Have a course that needs to be added to the list?

Interactive Map of Blockchain and Digital Asset Regulation

Hover over a country to see if they have information regarding regulation. Click on a country to learn more.

Unpacking Technical Standards

Technical standards for developments in blockchain and digital assets, as in any new technology, are fundamental to ensure safety, reliability, and further innovation. They establish common guidelines, definitions, and rules of the game through technical criteria, specifications, methodologies, and practices which all serve to ensure adequate functionality as well as the levels of interoperability, trust, and ease of use necessary for stakeholders to work together. Collaboration is fundamental for the growth of an industry, in ways that will ultimately lead to widespread acceptance of formalized rules and regulations. This repository of 50 technical standards bodies is meant to provide an objective overview of the state of standards developments today for blockchain and digital assets, with no vested interests from any particular organization.

We worked to make it easier for readers to identify how they can work with other groups, and for industry standards organizations to identify for gaps, opportunities, and areas for alignment. We worked to make it easier to compare across standards bodies based on their purpose and proposed outcome, while also allowing for self-identification based on their topics and industries of focus.

This is an ongoing collaborative work, where we welcome the community to provide feedback or suggest additional standards bodies for this list.

Number of Technical Standards Bodies by Proposed Outcomes

- Conduct / Governance 37%

- Technical 28%

- Regulatory 15%

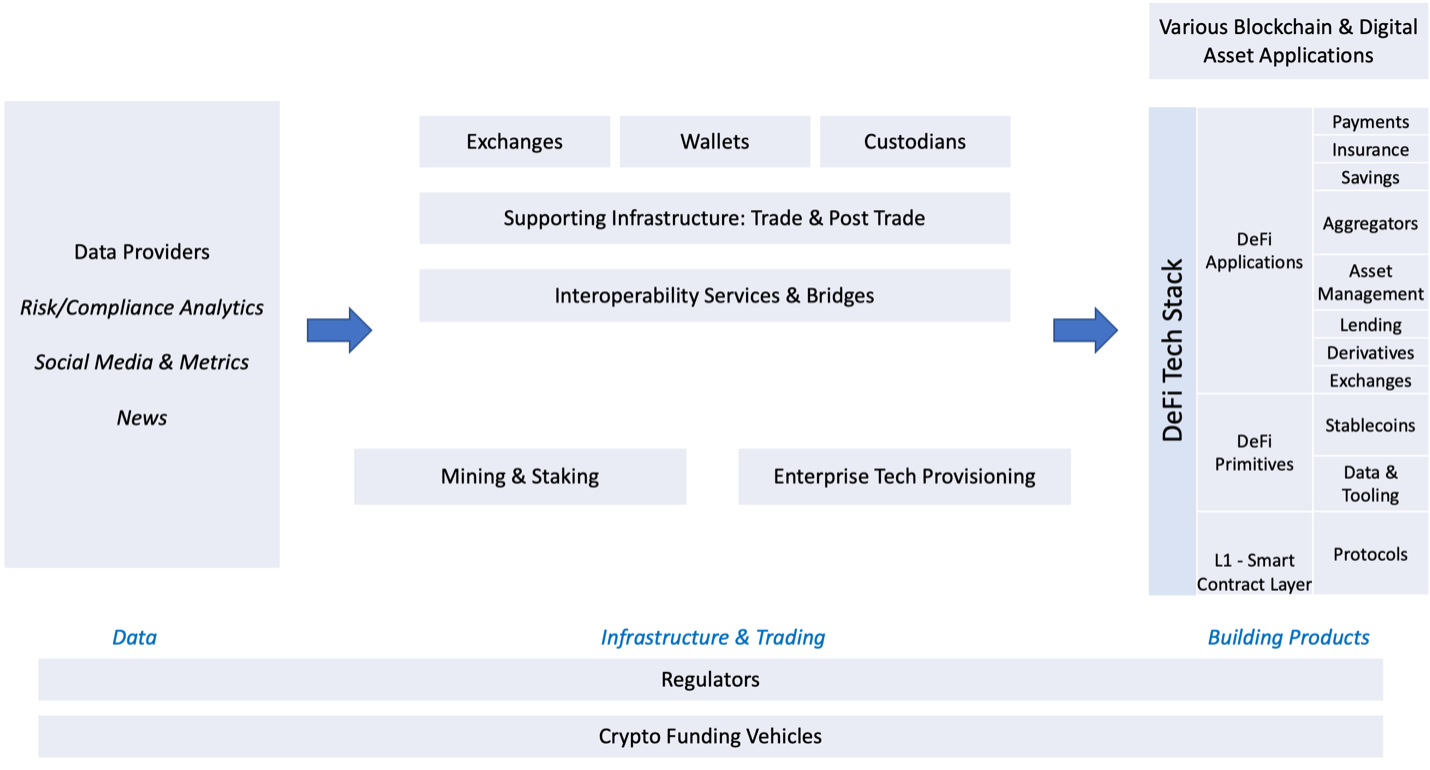

Blockchain and Digital Assets Landscape

The blockchain and digital assets landscape is made up of products, services, platforms, and infrastructure that together support a wide range of developments and applications. Use cases and infrastructure developments are unfolding across all industry verticals, bringing a new generation of decentralized business models that rely heavily on communities of users and participants in order to make decisions and scale. A global mapping of this landscape, with key stakeholders and their interactions, is summarized below. The GSMI 3.0 team also provides access to the full list of players, and welcomes further suggestions from the community.

Key Stakeholders in the Blockchain & Digital Assets Landscape.

Developing GSMI 3.0: Partner Programs

2022 IFC-Milken Scholars

The GBBC is pleased to introduce our 2022 IFC-Milken Institute Capital Market Scholars, Marwan Gzllal and Edmund Tamuke, who play a key role in assisting with the development and creation of GSMI 3.0; a continuation and expansion of a comprehensive effort to map global standards and regulation for blockchain and digital assets.

The eighth cohort of IFC-Milken Institute Capital Market Scholars includes 25 participants from 18 countries (Bangladesh, Botswana, Cameroon, Egypt, Ghana, Kazakhstan, Kenya, Libya, Nigeria, Pakistan, Rwanda, Senegal, Seychelles, Sierra Leone, South Africa, Tanzania, Uganda, and Uzbekistan).

2022 Fellows Program

The GBBC partnered with five academic institutions actively involved in blockchain and digital asset research to launch the 2022 GSMI Fellows Program, an eight-month fellowship for exceptional students from partners institutions to contribute to GSMI 3.0 research and analysis.

Partner Institutions

- University of Zurich

- Nagoya University of Commerce & Business

- University of Birmingham

- Singapore Management University

- University of Arkansas Walton College of Business

Road to GSMI 3.0

Interested in a specific topic? Find the in-depth reports below:

GSMI 1.0

Technical Standards

GSMI 2.0

Digital and Crypto Asset Regulation

GSMI 2.0

Digital Identity

GSMI 2.0

South Korea

GSMI 2.0

Introduction to Crypto Derivatives

GSMI 2.0

Crypto Derivatives: Legal and Regulatory Mapping

GSMI 2.0

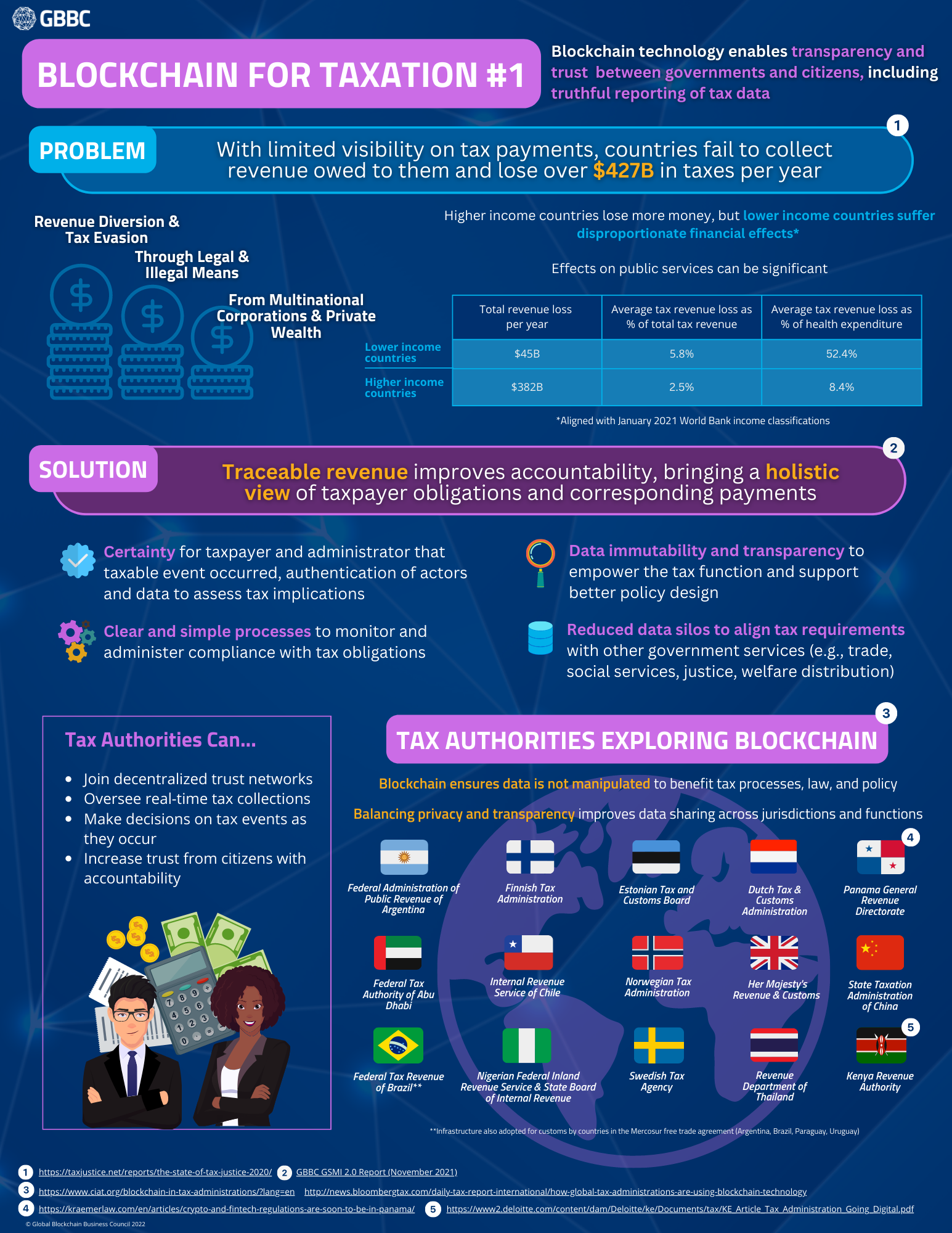

Global Taxation

Fact Card Series

GSMI 3.0 introduces a Fact Card Series that builds on prior GSMI research. We look to highlight key subjects on blockchain and digital assets, through educating and establishing understanding in order to drive this technology forward and foster strategic partnerships.

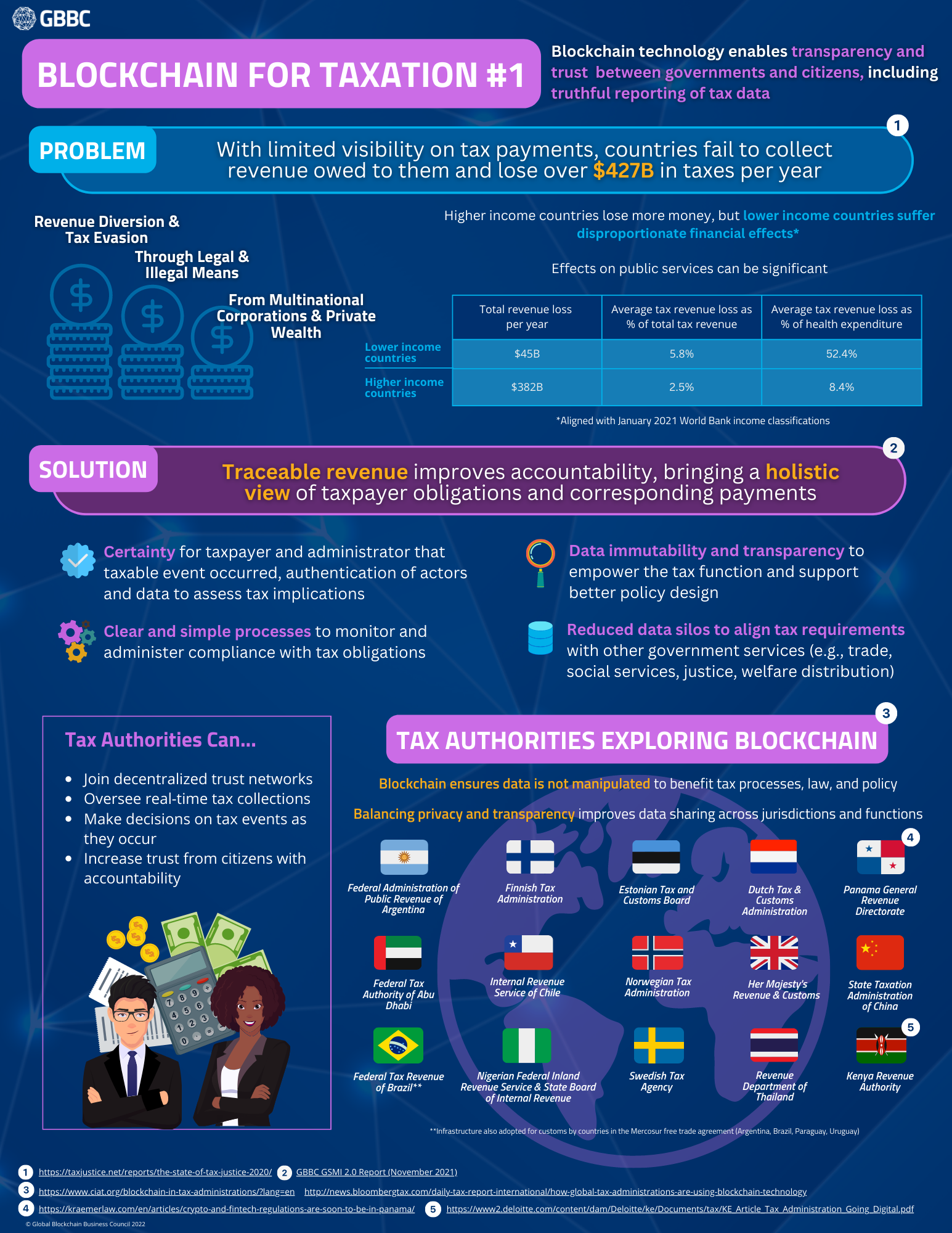

Taxation Series

3 November 2022

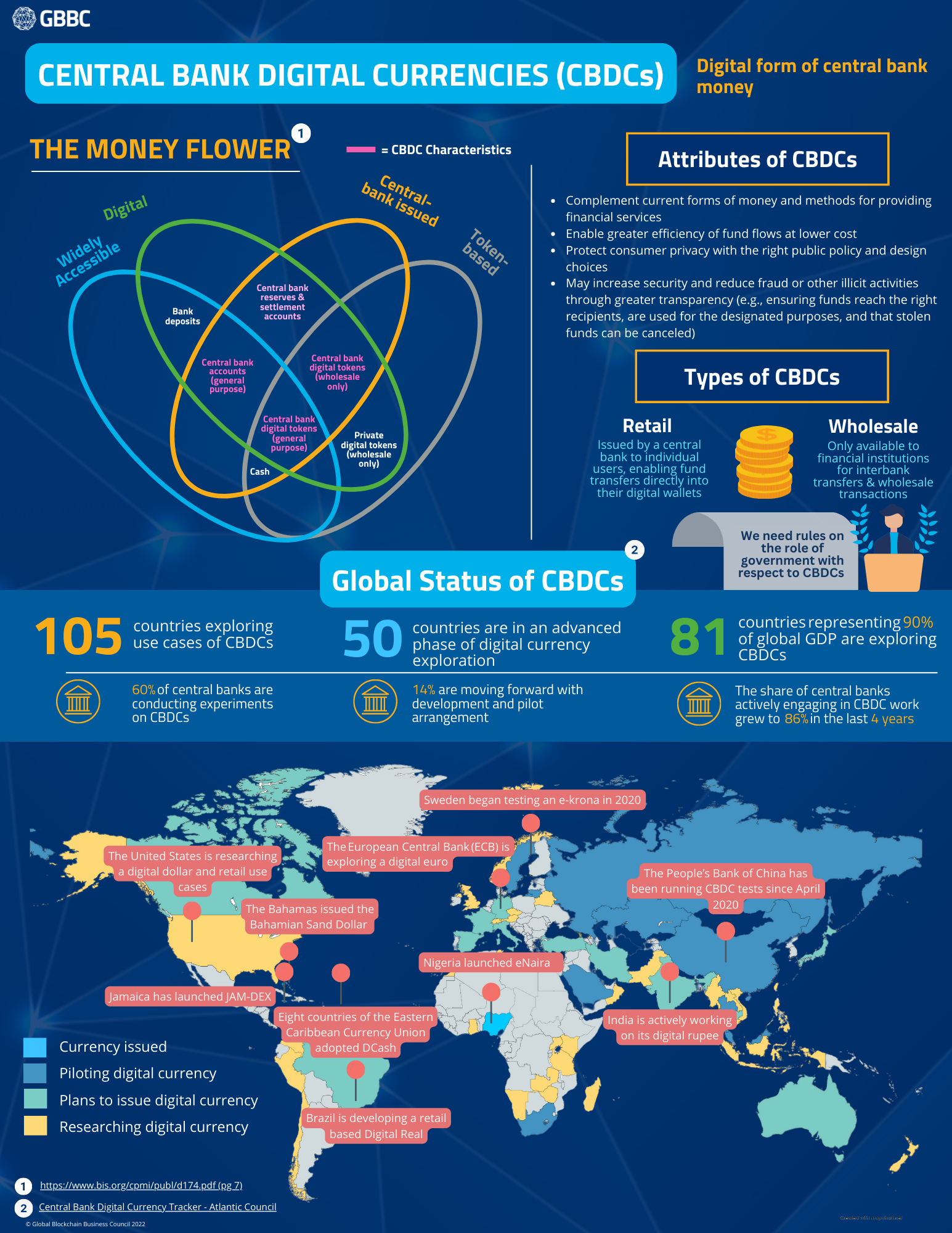

CBDCs

20 October 2022

Taxation #2

3 November 2022

The Green Economy

20 September 2022

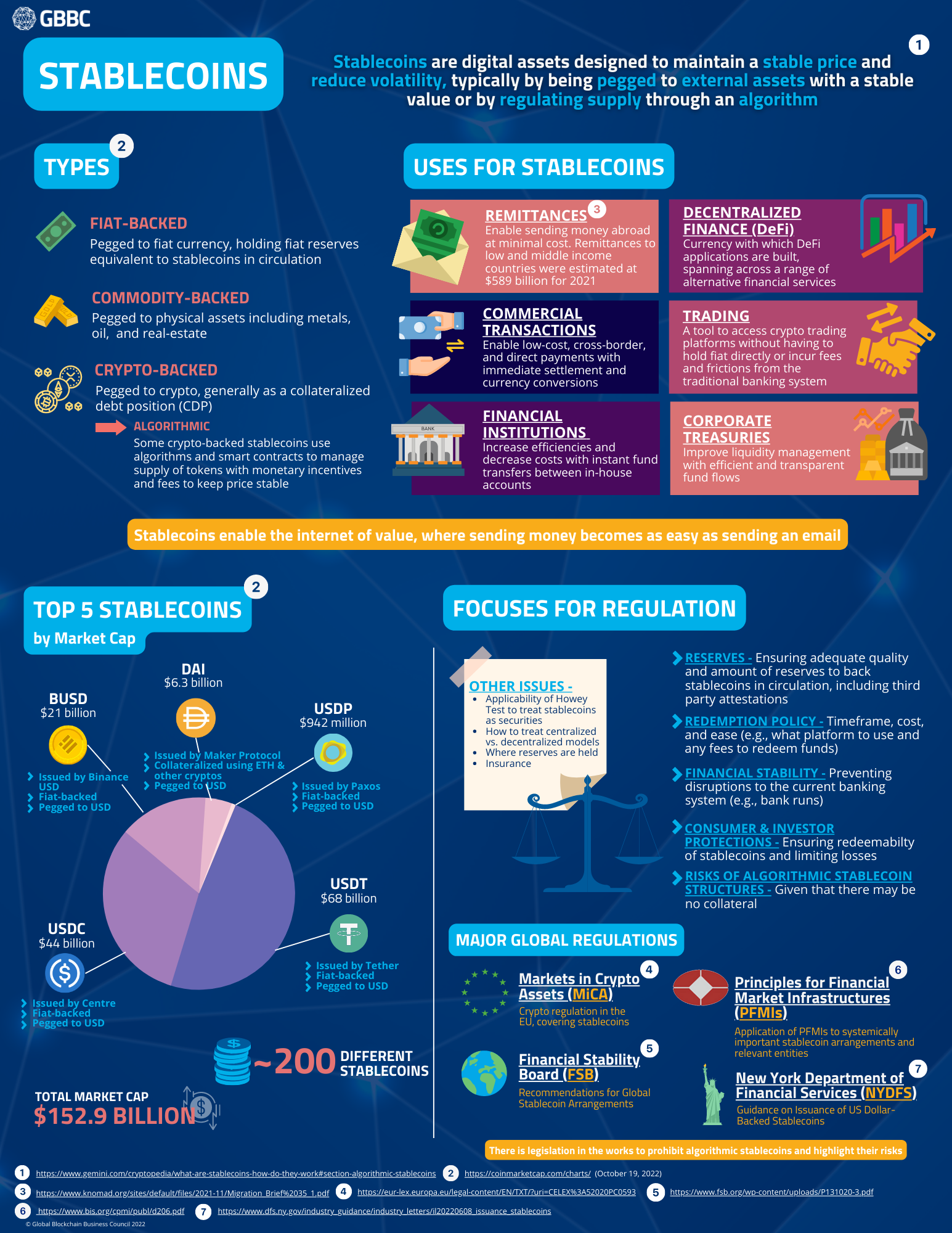

Stablecoins

20 October 2022

Taxation #3

3 November 2022

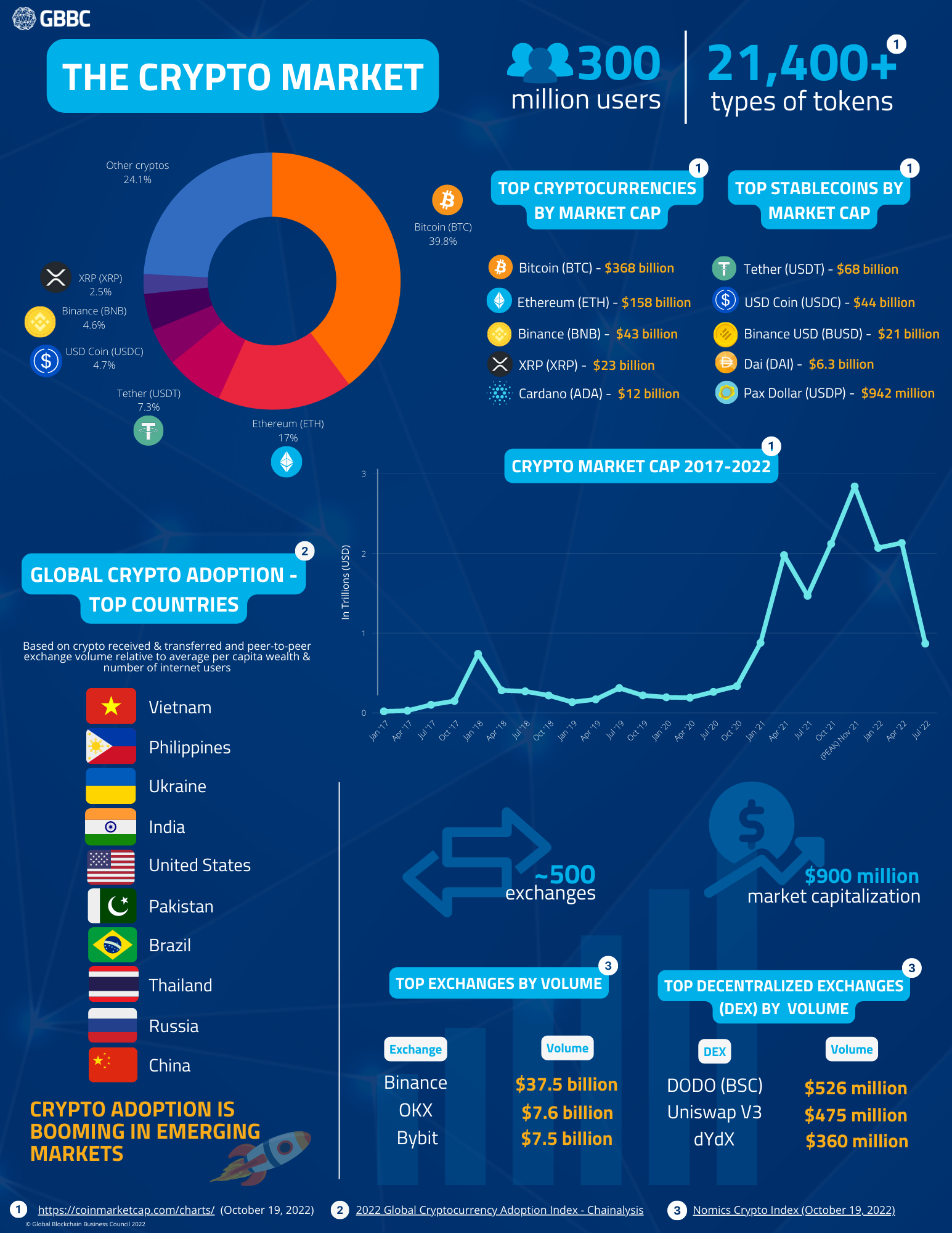

Crypto Market

20 October 2022

Taxation #1

3 November 2022