Global Standards Mapping Initiative (GSMI)

Comprehensive resources and recommendations for the blockchain and digital assets community to navigate the complexities of the global landscape across 6 key areas:

Legislation & Regulatory Developments

Taxonomy & Definitions

Technical Standards

Blockchain & Digital Assets Landscape

Courses from Accredited Educational Institutions

Reports & Fact Cards on Key Themes

Legislation & Regulatory Developments

Interactive Map

Hover over a country to see if they have information regarding regulation. Click on a country to learn more.

Taxonomy & Definitions

In order to foster the level of collaboration across stakeholders necessary for scale, it is essential to operate under a common language. As the space develops at lightning speed, where definitions can evolve at the pace of new applications being launched, common understanding has become both increasingly critical and progressively complex. The need for clear and consistent communication is more important than ever, underscored by universally accepted definitions. Shared language creates the foundation for collaborative understanding and progress, bringing together stakeholders with shared interests to advance common goals and standards. Blockchain, often in combination with other emerging technologies, is already breaking silos and progressing substantive solutions to move our world in a positive direction and meet the most pressing challenges of our time.

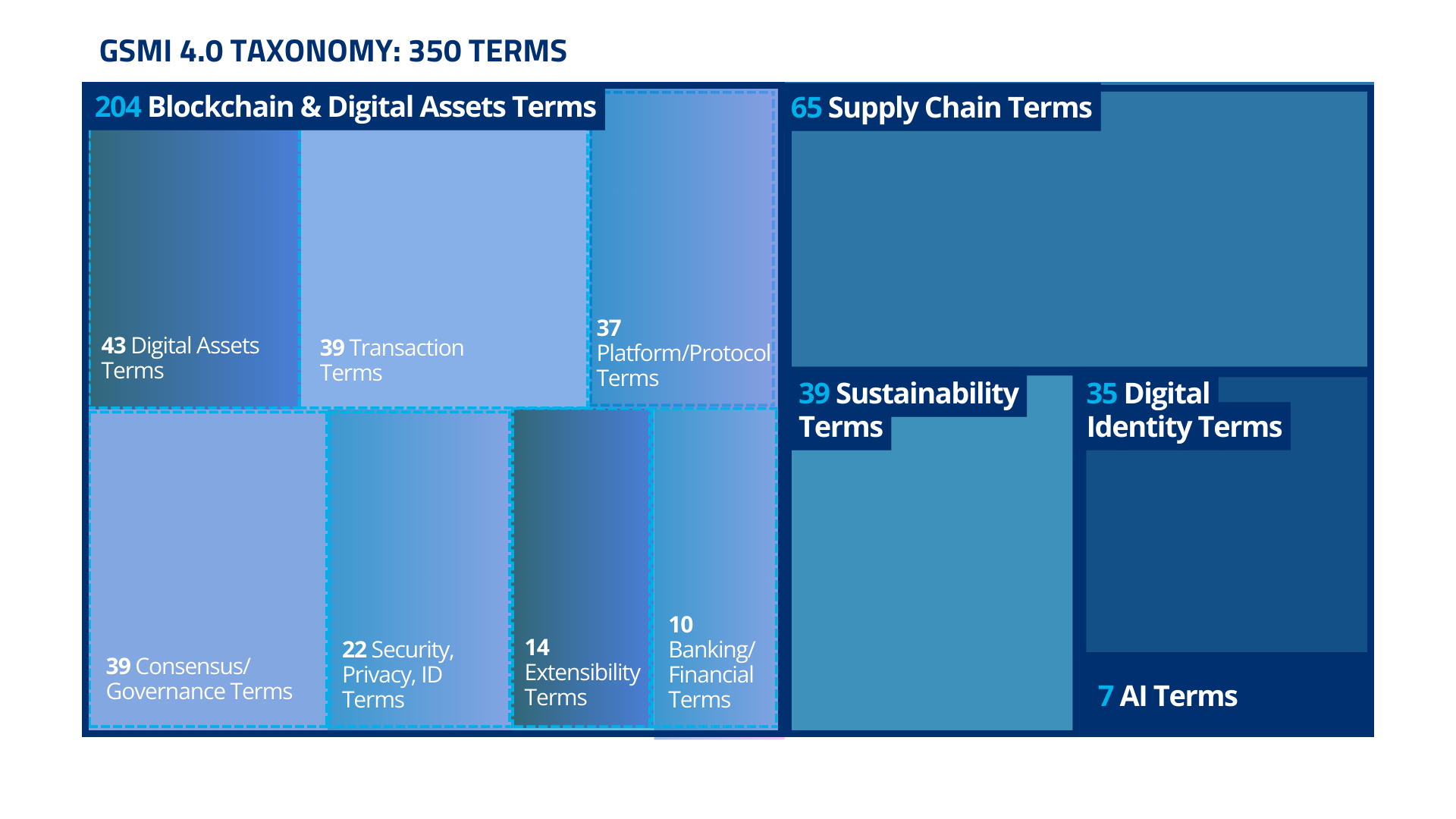

The GSMI Taxonomy includes 350 terms specific to blockchain and digital assets, categorized as essential terms, non-essential terms, and sector-specific terms. Terms considered essential to blockchian and digital assets have been further categorized into main subject areas specific to the space, drawing on prior academic categorizations utilized in existing taxonomies. Each term has been cross-checked against definitions from multiple globally respected standards setting bodies and industry-specific glossaries. Therefore there are multiple definitions for most terms, in order to reflect the fact that the space is still developing and that the definitions are continuously evolving. This landscape of terms and definitions is meant to capture the full meaning of each concept as it is utilized in the industry today.

This taxonomy is meant to be an interactive resource, where users can pick a definition from the landscape of sources listed in the drop-down menu for each term. It is also meant to be a dynamic resource that will evolve over time as the space continues to develop.

At the core of the GSMI taxonomy is the acknowledgement that global innovators creating solutions to address society’s toughest challenges need globally accepted standards to facilitate impactful and responsible cross-border innovation. This work builds on materials and knowledge from prior shared taxonomies, and in highlighting industry-specific concepts, emphasizes the tangible ways that this technology can transform our everyday lives.

Moreover, often regulatory clarity follows advances in collaborative developments resulting in applications that work well across stakeholders, where a shared acceptance of best practices is built on common terminology and understanding. Taxonomy is imperative for harmonized global regulatory developments which are fundamental for scale and credibility. Regulators around the world have produced taxonomies to classify digital assets, as well as definitions preceding statutes, as part of comprehensive frameworks in development that are tailored for this space. This resource is meant to be utilized as a resource to support such efforts.

Finally, we welcome recommendations and additional resources that will enable us to further refine the quality and scope of this effort.

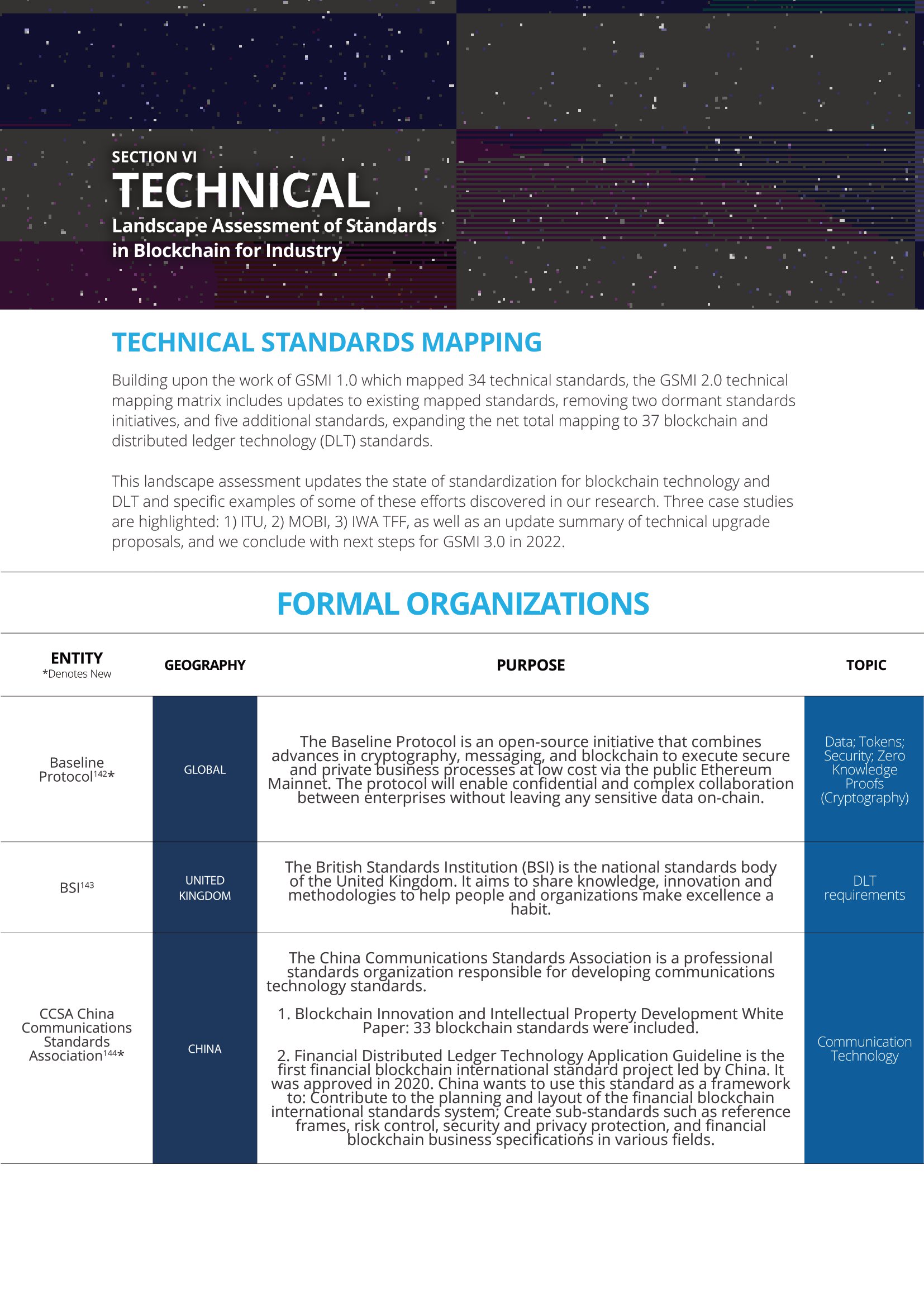

Technical Standards

Technical standards for developments in blockchain and digital assets, as in any new technology, are fundamental to ensure safety, reliability, and further innovation. They establish common guidelines, definitions, and rules of the game through technical criteria, specifications, methodologies, and practices which all serve to ensure adequate functionality as well as the levels of interoperability, trust, and ease of use necessary for stakeholders to work together. Collaboration is fundamental for the growth of an industry, in ways that will ultimately lead to widespread acceptance of formalized rules and regulations. This repository of 63 technical standards bodies is meant to provide an objective overview of the state of standards developments today for blockchain and digital assets, with no vested interests from any particular organization.

We worked to make it easier for readers to identify how they can work with other groups, and for industry standards organizations to identify for gaps, opportunities, and areas for alignment. We also worked to make it easier to compare across standards bodies based on their purpose and proposed outcome, while also allowing for self-identification based on their topics and industries of focus.

Standards in the space are marked according to their proposed outcome, which may be technical standards and specifications, regulatory compliance, or best practices and governance. The standards bodies are also categorized by their main function as global or regional standards setters or associations, and whether they may have a regulatory affiliation.

This is an ongoing collaborative work, where we welcome the community to provide feedback or suggest additional standards bodies for this list.

Number of Technical Standards Bodies by Proposed Outcomes

Conduct / Governance

Technical

Regulatory

Blockchain & Digital Assets Landscape

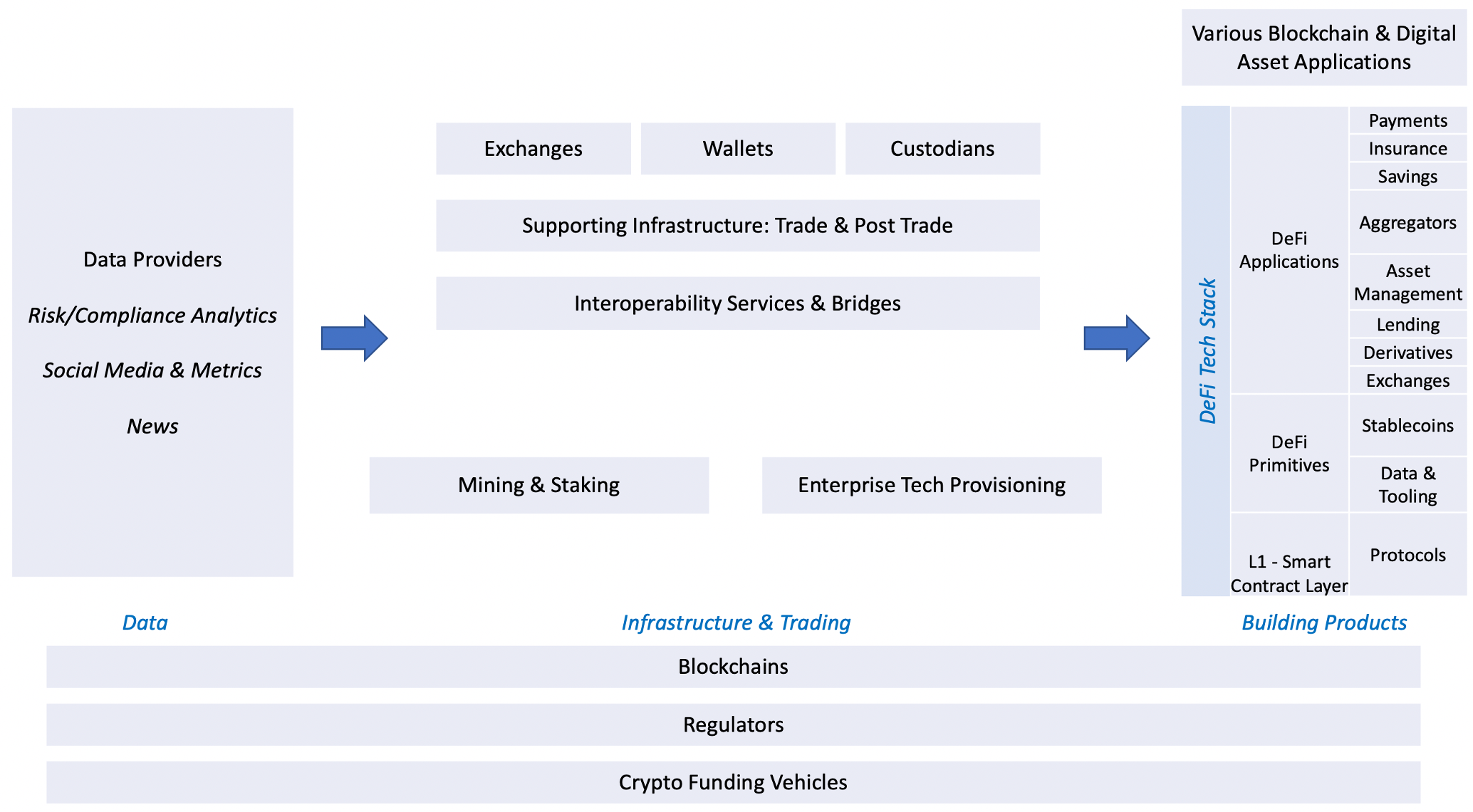

The blockchain and digital assets landscape is made up of products, services, platforms, and infrastructure that together support a wide range of developments and applications. Use cases and infrastructure developments are continuing to unfold across all industry verticals, bringing a new generation of decentralized business models that rely heavily on communities of users and participants in order to make decisions and scale. GSMI 4.0 offers a continually updated global mapping of this landscape, with key stakeholders and their interactions, as summarized in the diagram. GSMI 4.0 also provides access to the full list of 2,000+ players, and welcomes further suggestions from the community. We are in the early innings of this multi-trillion dollar industry, with many more developments underway and innovations to come.

Key Stakeholders in the Blockchain & Digital Assets Landscape.

# of Courses

Courses from Accredited Educational Institutions

Where is Blockchain Being Taught?

Blockchian is being increasingly incorporated into the curriculum taught at universities and other educational institutions around the world, offering academic degrees and other certifications. We have compiled this repository of over 1,500 courses spanning multiple academic disciplines. We hope that by compiling this repository of courses related to blockchain, we will make it easier for those looking to get a more formal education to access the training they want. We also hope this resource can also help educators and researchers connect with each other to promote knowledge sharing and other collaborations such as research on common topics. Below is a listing of blockchain-related courses in universities and other educational institutions, as well as a form to collect additional submissions for courses. Students, professors, and other university staff can submit their blockchain courses for inclusion through this form and apply for the GBBC observing membership program.

Courses by

Academic Field

Courses by

Region

Courses by

Degree Level

Reports & Fact Cards on Key Themes

Reports

The GSMI Report Series is the result of various working groups convening over months to address the most pressing issues for blockchain and digital assets. We bring together academics, corporate executives, government organizations, and startups to build on each other’s different perspectives, share experiences, and ask the right questions to advance effective solutions to current challenges.

Artificial Intelligence (AI) & Convergence

GSMI 4.0

Sustainability

GSMI 4.0

Technical Standards Short Paper: Standards

GSMI 4.0

Technical Standards

GSMI 2.0

(Summary) Digital ID

GSMI 2.0

(Summary) Policy

GSMI 2.0

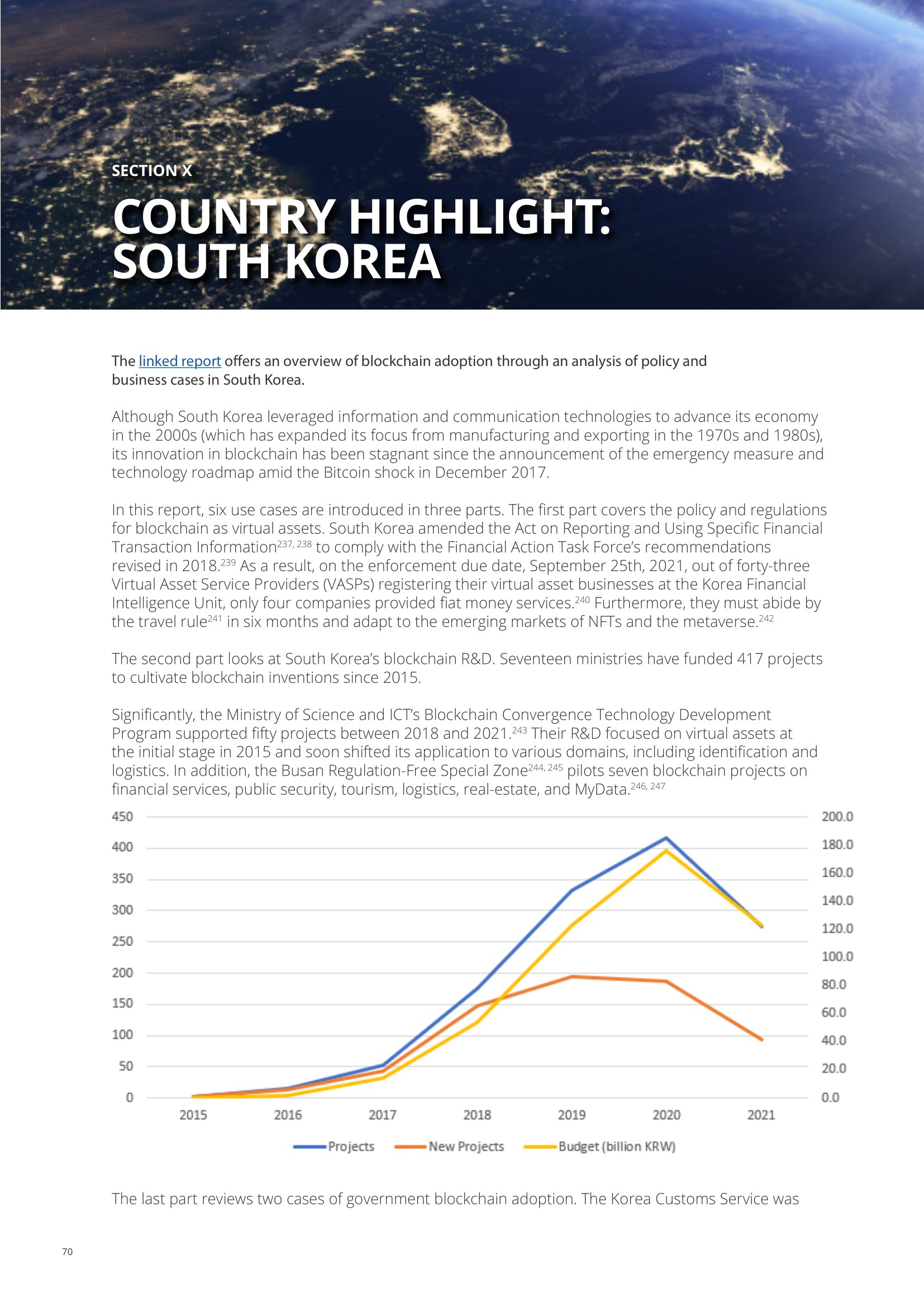

(Summary) South Korea

GSMI 2.0

South Korea

GSMI 1.0

Digital Identity

GSMI 4.0

Country Spotlight: Brazil

GSMI 4.0

Technical Standards – Validators & Governance

GSMI 3.0

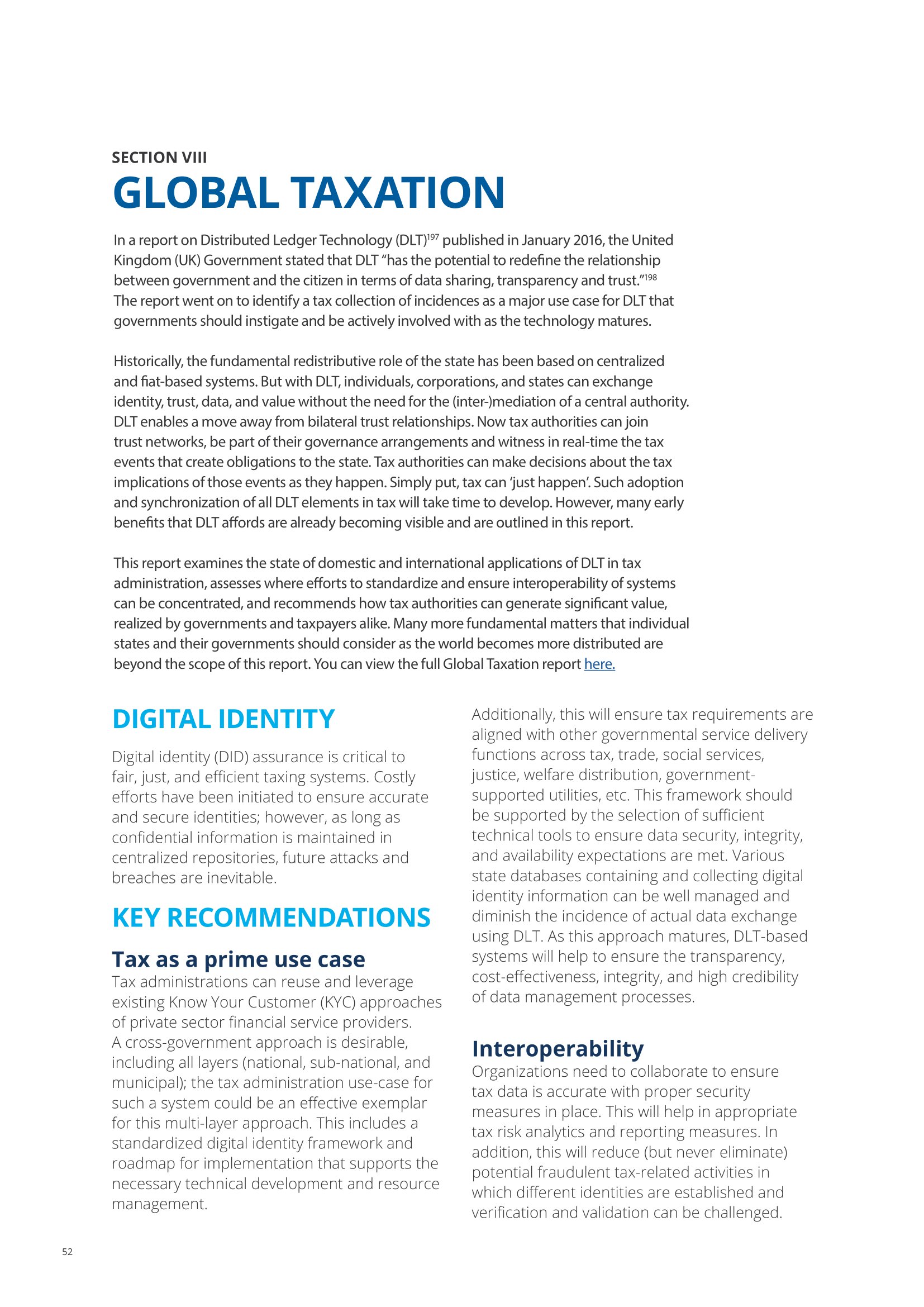

Global Taxation

GSMI 2.0

(Summary) Derivatives

GSMI 2.0

(Summary) Global Taxation

GSMI 2.0

(Summary) Technical Standards

GSMI 2.0

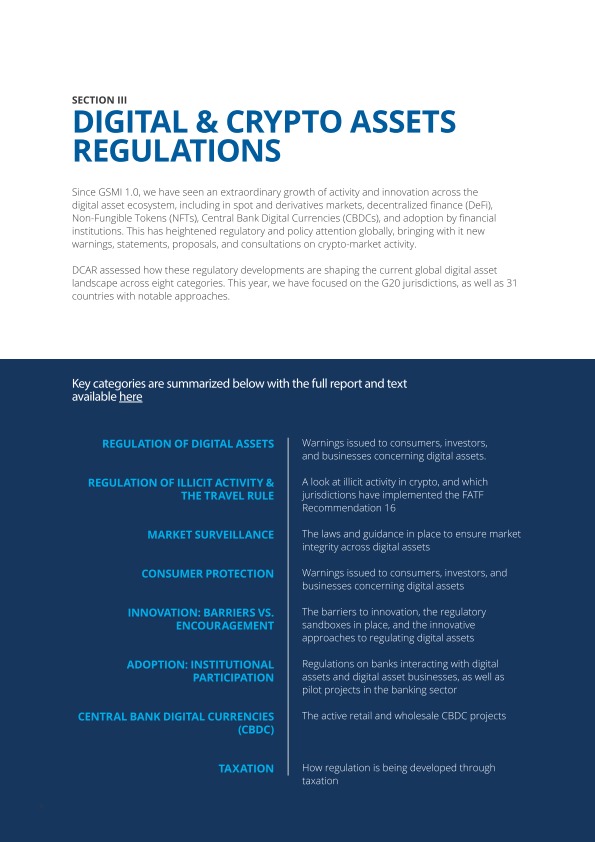

Digital and Crypto Asset Regulation

GSMI 1.0

Supply Chain

GSMI 4.0

Technical Standards Short Paper: DeFi

GSMI 4.0

Digital Identity

GSMI 2.0

Introduction to Crypto Derivatives

GSMI 2.0

(Summary) Crypto and DA Regulation

GSMI 2.0

(Summary) Green Economy

GSMI 2.0

Crypto Derivatives: Legal and Regulatory Mapping

GSMI 1.0

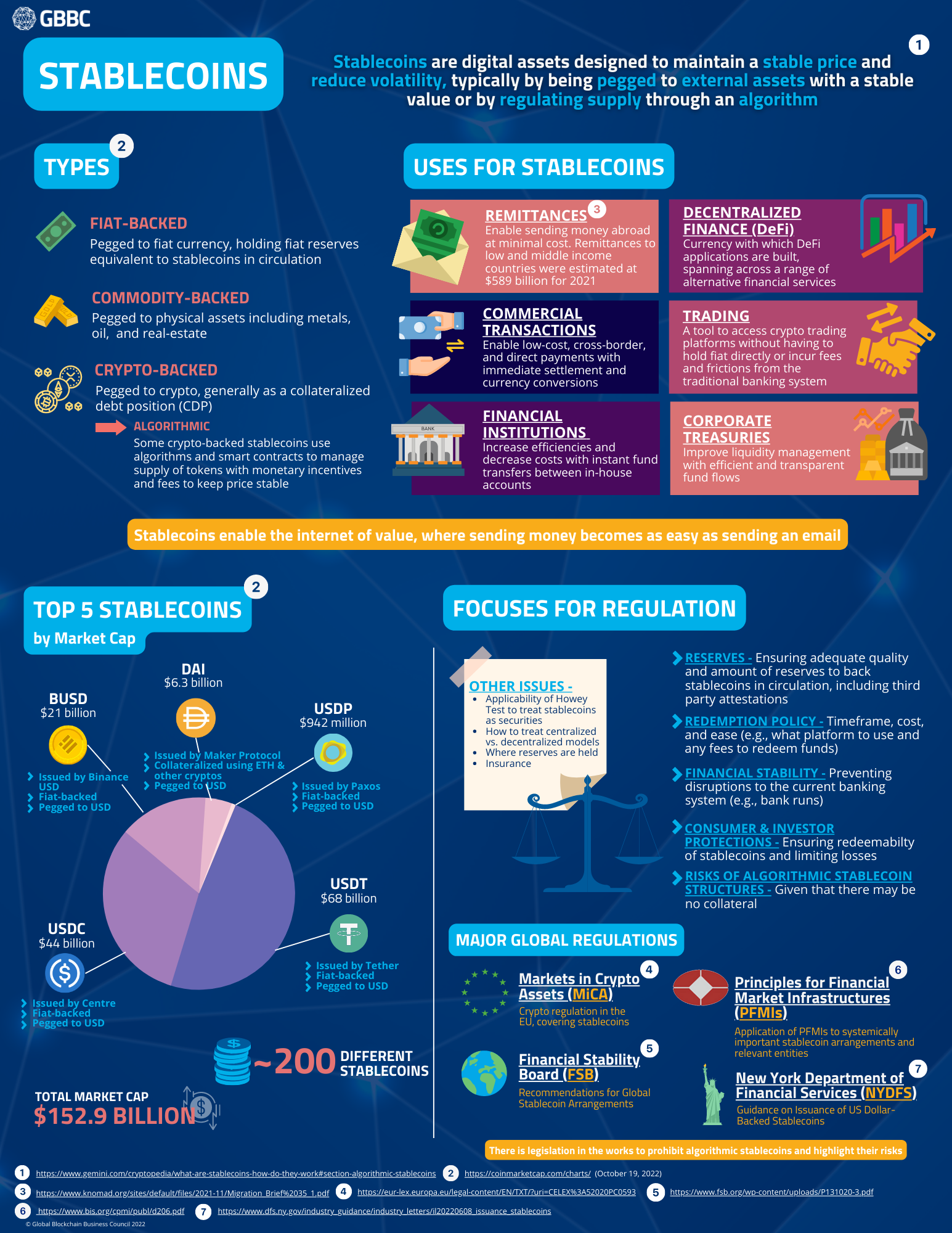

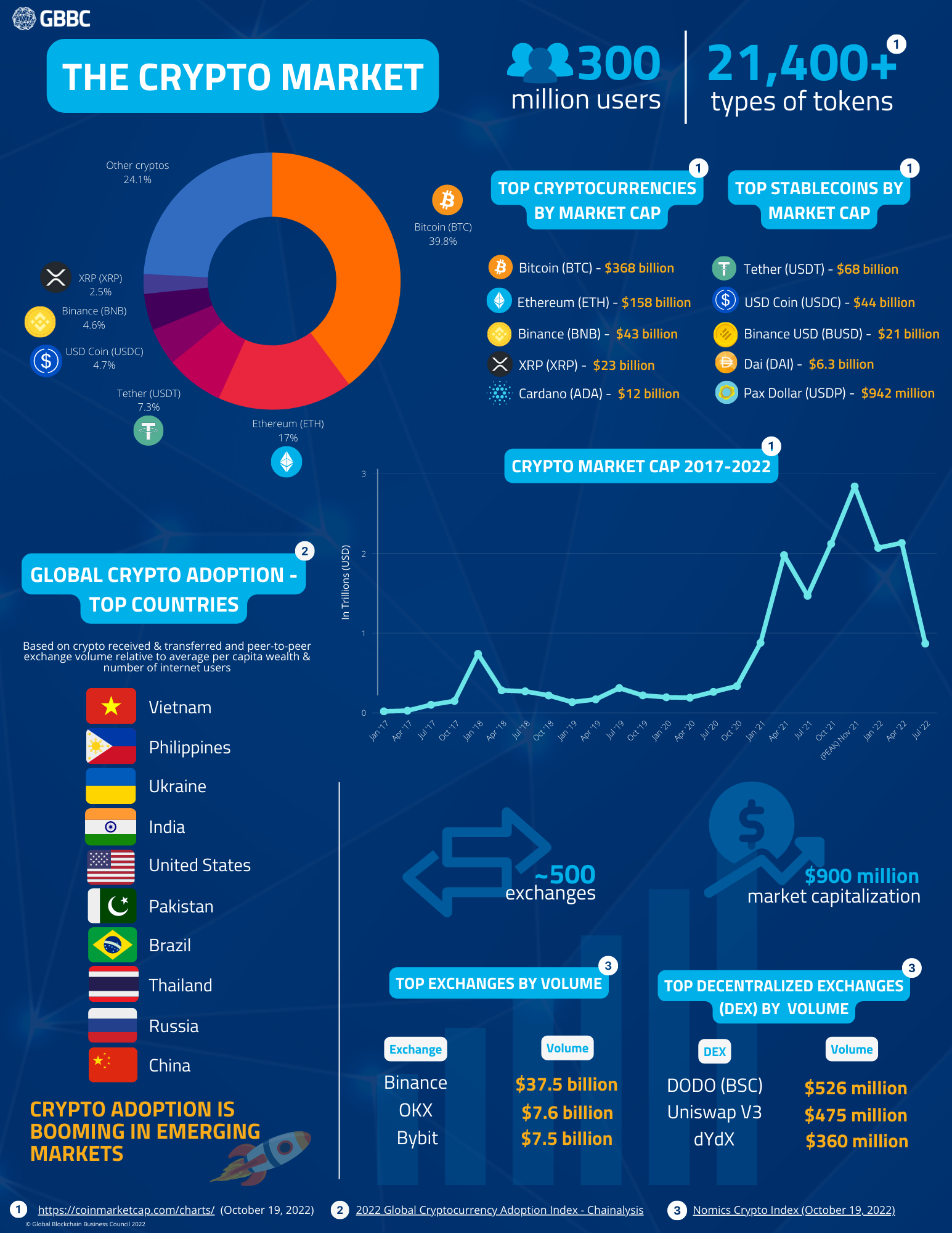

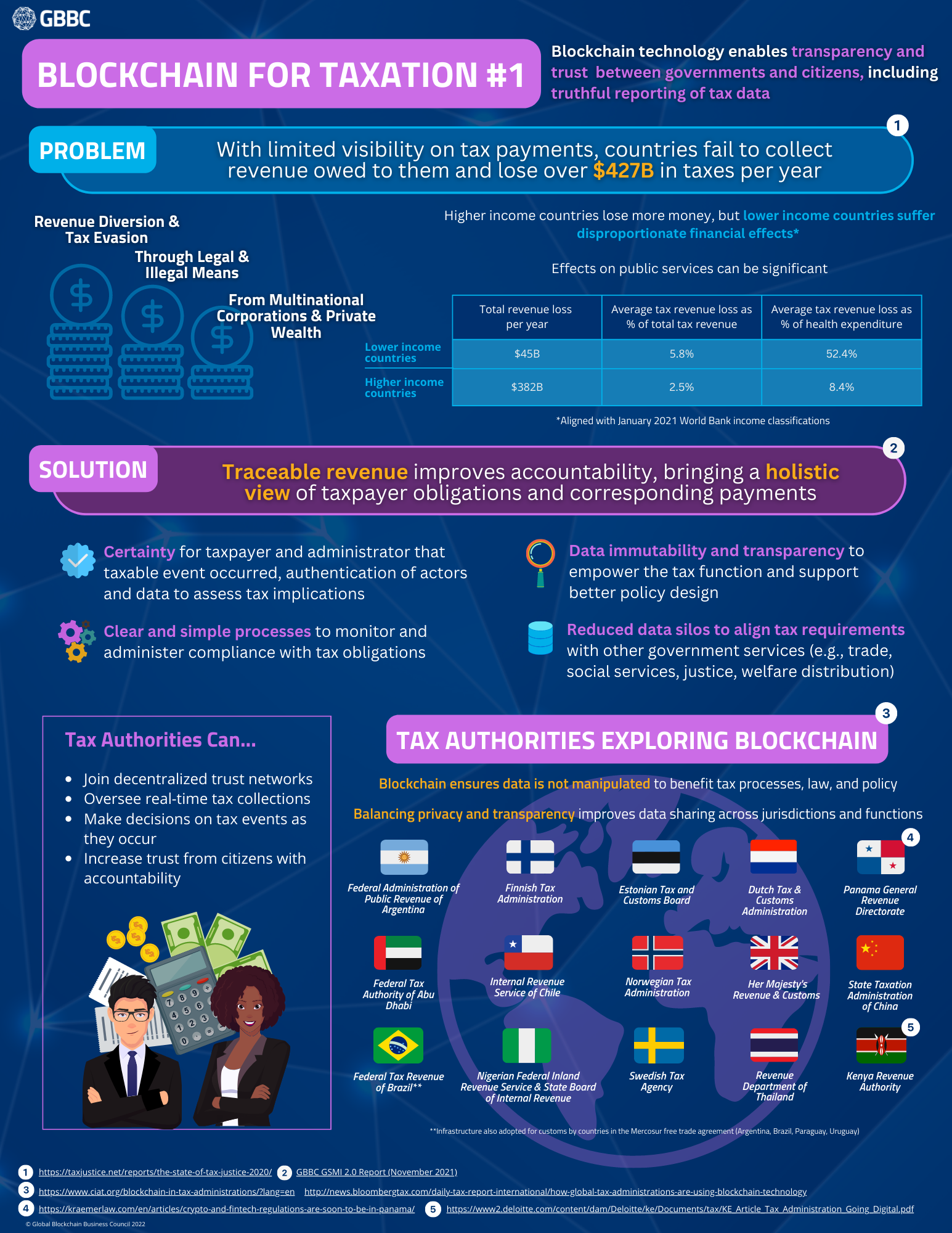

Fact Cards

The GSMI Fact Card Series builds on prior research and reports, visually portraying key subjects on blockchain and digital assets in the most meaningful ways. By educating and establishing understanding, we hope to drive this technology forward and foster strategic partnerships.

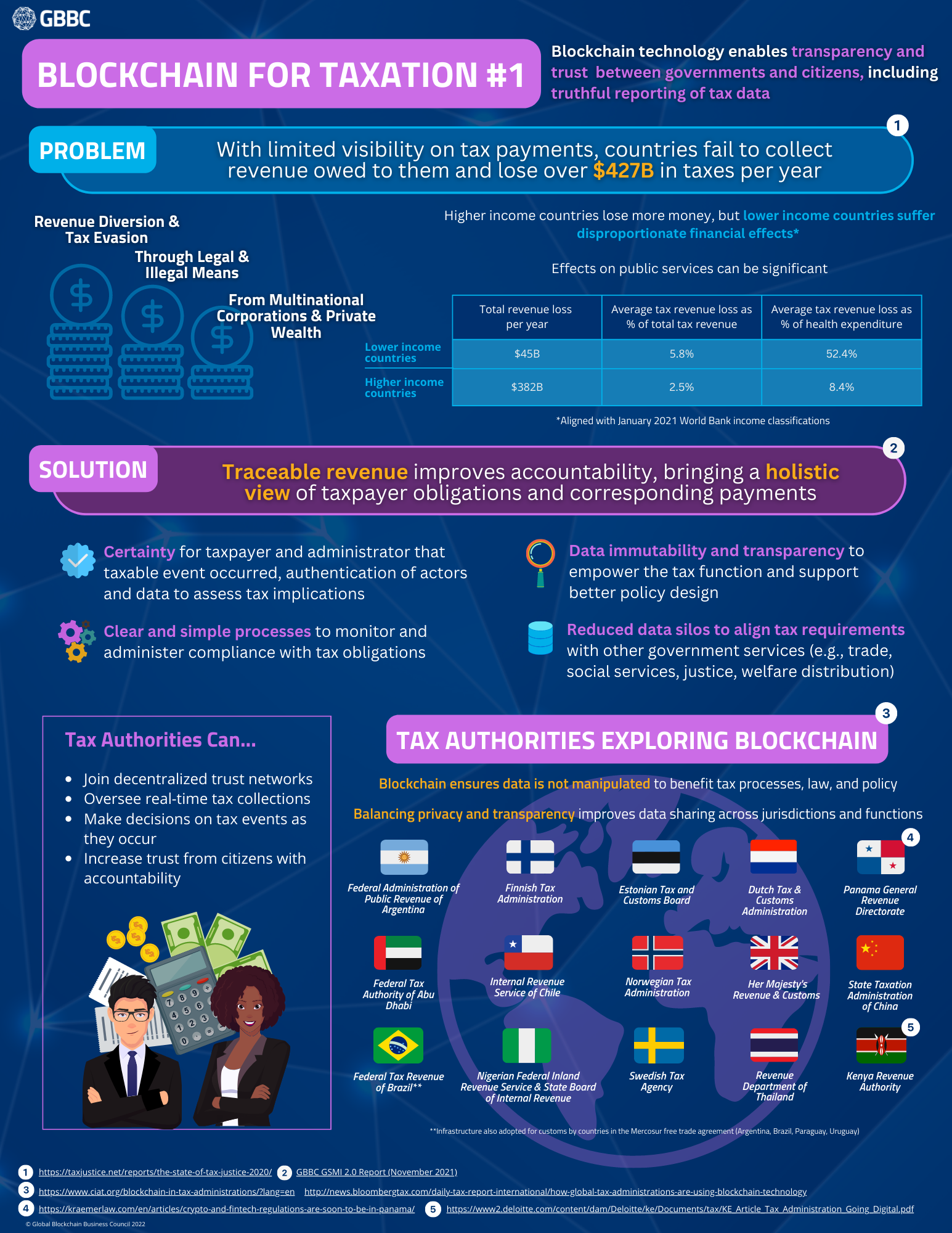

Taxation Series

3 November 2022

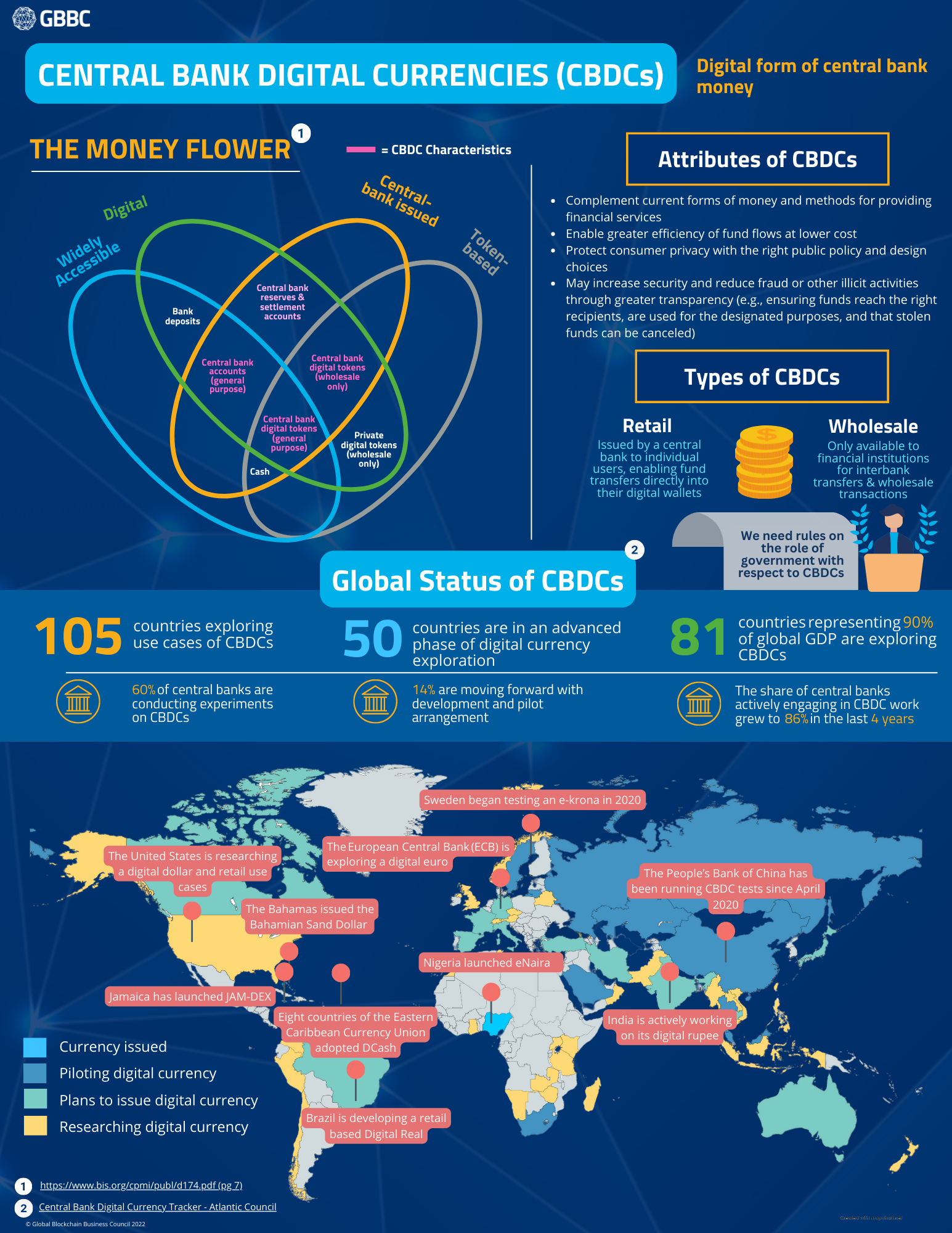

CBDCs

20 October 2022

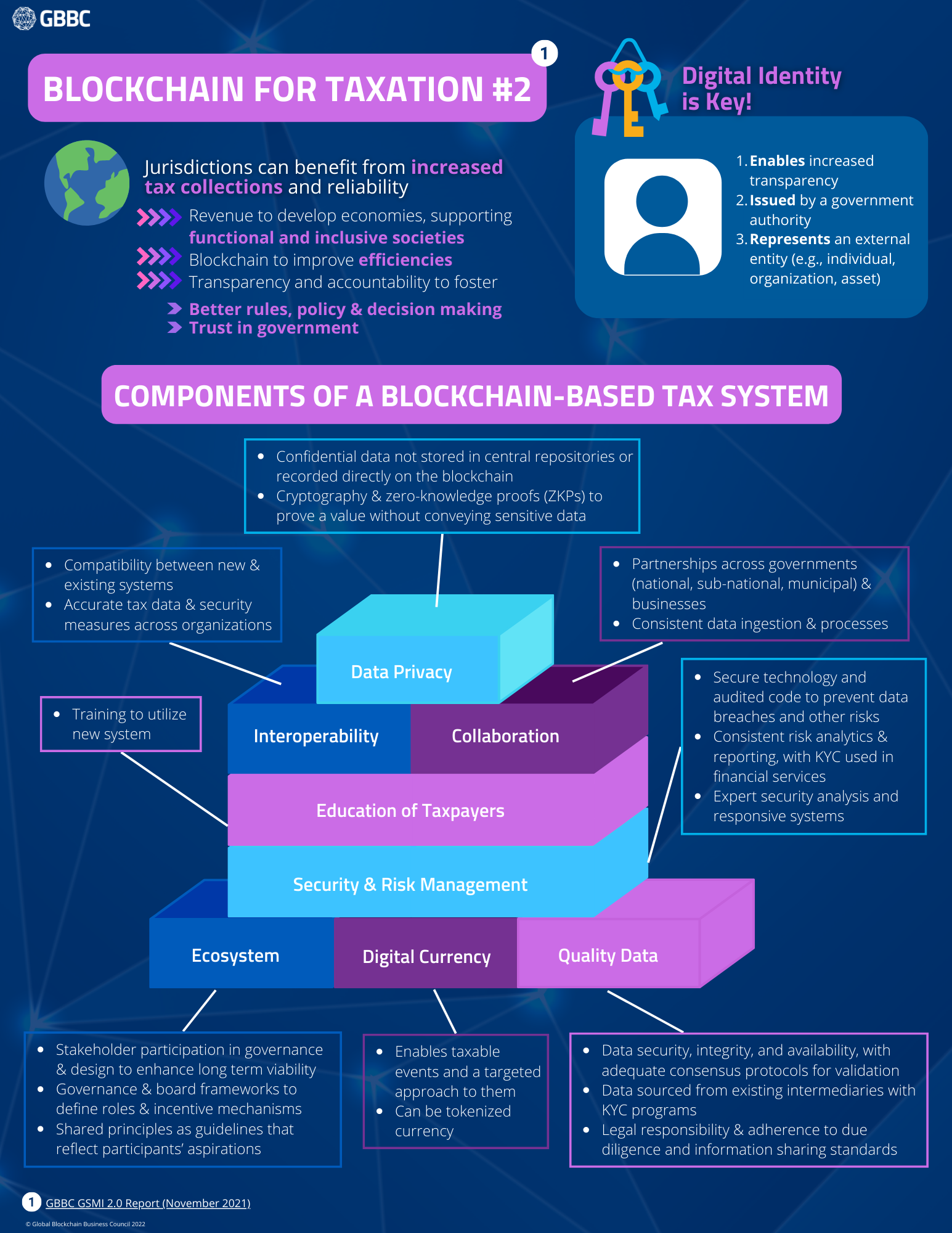

Taxation #2

3 November 2022

The Green Economy

20 September 2022

Stablecoins

20 October 2022

Taxation #3

3 November 2022

Crypto Market

20 October 2022

Taxation #1

3 November 2022

Key Findings

- Global Regulatory Developments from 230 Jurisdictions & 6 International Bodies

- Taxonomy with 350 Terms & Definitions

- 63 Technical Standards Bodies Advancing Blockchain Developments

- Landscape with 2,000+ Stakeholders

- 1,500+ Courses from Accredited Educational Institutions

- 4 In-Depth Reports & Visuals on AI Convergence, Digital Identity, Supply Chain & Sustainability

- Country Spotlight on Brazil

Developing GSMI 4.0: Partner Programs

2023 IFC-Milken Scholars

GBBC is pleased partner with the IFC-Milken Institute Capital Markets Program, which builds a global network of financial policy leaders, and introduce our 2023 IFC-Milken Institute Capital Market Scholars, Abror Mirzo Olimov and Gabriela Shibata. They play a key role in assisting with the development and creation of GSMI 4.0, a continuation and expansion of the comprehensive effort to map global standards and regulation for blockchain and digital assets.

The tenth cohort of IFC-Milken Institute Capital Market Scholars includes 16 participants from 10 countries (Albania, Brazil, Egypt, Indonesia, the Philippines, Sierra Leone, South Africa, Tanzania, Uzbekistan, and Vietnam).

2023 GSMI Fellows Program

GBBC partnered with Queens College in New York for the 2023 GSMI Fellows Program, an eight-month fellowship for exceptional students from partner academic institutions who contribute to GSMI 4.0 research and analysis. Our GSMI Fellows Joseph Haar and Ishraq Huda, both students at Queens College, are actively involved in research on blockchain and digital assets to advance educational initiatives and taxonomy.

MEET THE 2023 IFC-MILKEN SCHOLARS

MEET THE 2023 GSMI FELLOWS

Road to GSMI 4.0